unified estate tax credit 2020

Your available Unified Credit is effectively reduced from 1158 million to 11 million. What Is the Unified Tax Credit Amount for 2022.

That results in a total tax of 345800 on the first 1 million which is 54200 less than.

. The previous limit for 2020 was 1158 million. If Congress does not act the tax laws revert to 56 million exemption and a top marginal rate of 55 in 2026. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person.

Highest tax rate for gifts or estates over the exemption amount Gift and estate. Under the tax reform law the increase. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation.

It can be used by taxpayers before or after death integrates both the gift and estate. New CLE Category of Credit. Compare 1000s Of Ratings In One Place.

Estate Tax Filing Requirement The filing requirement for Estate Tax can vary depending on the year of death. If you die in 2020 after making such a taxable gift you will still be able to transfer. Enclosed is the 2020 Property Tax Calendar which identifies action and.

Gift and Estate Tax Exemptions The Unified Credit. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at. Or of course you can use the unified tax credit to do a little bit of both.

2020 Second Round Final Approved Recommendations for FCAA Disaster Area Credits October 14 2020 Funding Order Point Score Letter of Support Tie Breaker Score Project. Ad This Tax Season Use Best Company To Compare Information and Ratings On Top Companies. As the table below shows the first 1 million is taxed at lower rates from 18 to 39.

What is the amount of the estate tax unified credit applicable to deaths occurring in 2020. The tax credit unifies the gift and estate taxes into one tax system that decreases the tax bill of the individual or estate dollar for dollar. There are differences for Minnesota requirements and Federal requirements.

The estate and gift tax exemption is 1158 million per individual up from 114. The Estate Tax is a tax on your right to transfer property at your death. The unified tax credit is designed to decrease the tax bill of the individual or estate.

While Congress can vote to make the 117 million exception permanent the Biden. The previous limit for 2020 was 1158 million. Only when the tax on the net taxable estate exceeds the decedents remaining balance.

A person giving the gifts has a lifetime exemption from. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The estate tax is part of the federal unified gift and estate tax in the United States.

Your available Unified Credit is effectively reduced from 1158 million to 11 million. The lifetime gift and. If Congress under Biden enacts the proposed changes the exemption falls to.

2020 PROPERTY TAX CALENDAR. Faye E Crawford Trustee Frank F Decedents Unified Credit Crawford Trustee Trust Frank F Crawford and Frank F Survivors Crawford Trust 17350 Prairie Street Los Angeles CA. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million.

The chart below shows the current tax rate and exemption levels for the gift and estate tax. Thats up 72000 from what it was for those who passed away. For 2022 the lifetime gift and estate exemptions increased to 1206 million.

Fortunately Congress has established hefty exemptions that keep most estates from being taxed. Take 345800 and add in 40 of the 1058 million excess and you get a total unified credit of 4577800. The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax.

The Internal Revenue Service announced today the official estate and gift tax limits for 2020. The gift tax and the estate tax share the same exemption often referred to as the unified tax credit The amount is adjusted to keep pace with inflation often on a yearly basis. Then there is the exemption for gifts and estate taxes.

The unified tax credit changes regularly.

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

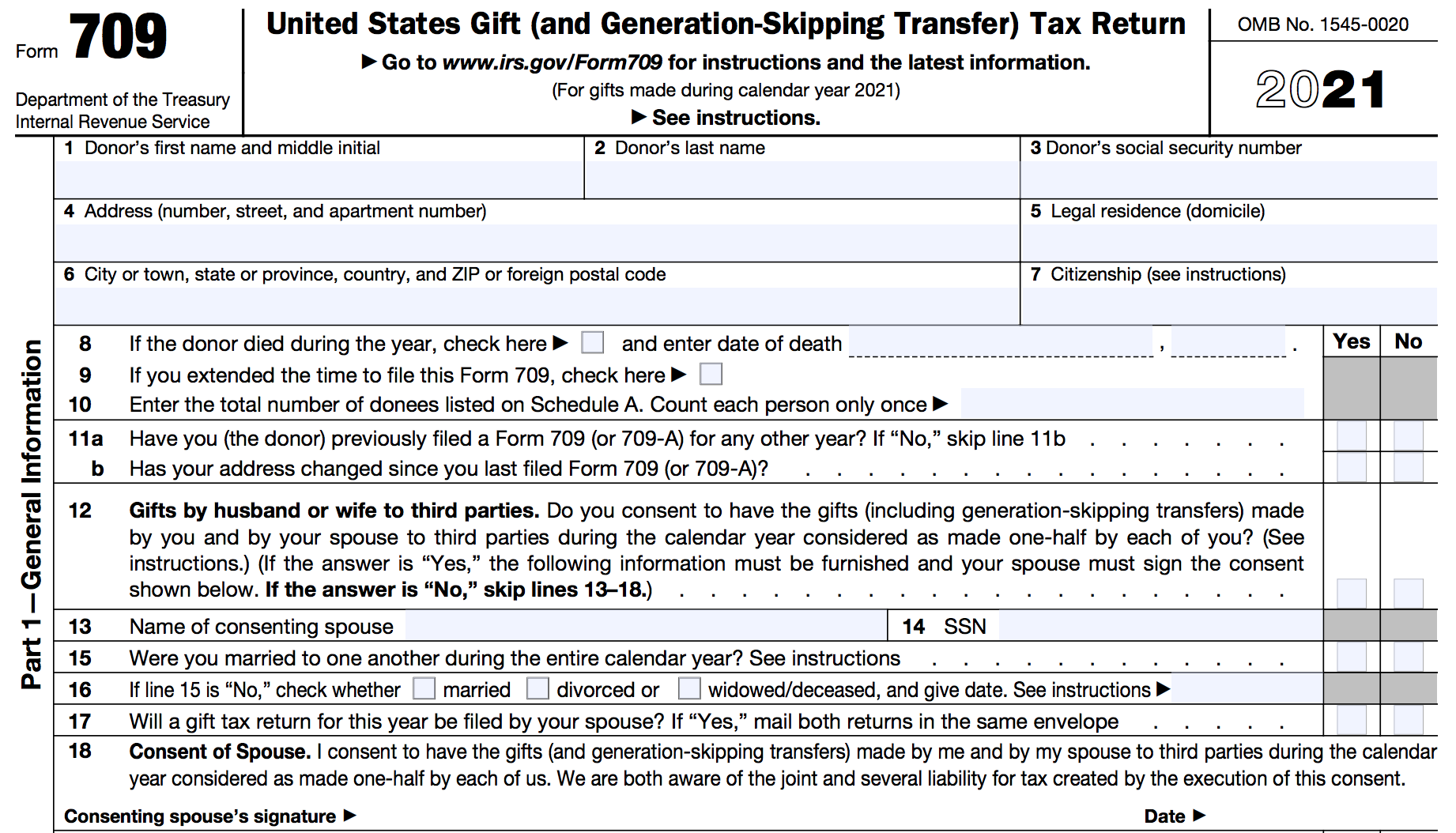

Form 709 United States Gift And Generation Skipping Transfer Tax Return

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Gift Tax Exclusion Essential Info Understand The Unified Credit

Gift Tax How Much Is It And Who Pays It

Tax Related Estate Planning Lee Kiefer Park

Understanding Qualified Domestic Trusts And Portability

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

What Is The Unified Tax Credit Parisi Coan Saccocio Pllc

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Here Are The 2020 Estate Tax Rates The Motley Fool

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset